Get an Instant Quote now or call 800-745-2416 to speak directly with an experienced, licensed agent

We all work to provide our loved ones with everything they need, but we never know when something may happen to us, leaving those that depend on us without our financial support. Life insurance can ease that burden by protecting your family’s lifestyle, including day-to-day expenses, college funds, weddings, and other significant life events. While many people know they need life insurance, there are common questions that we all ask ourselves.

When is it necessary to purchase a life insurance policy? Everyone is in a different stage of life, but it becomes most important when you have others depending on you such as spouses, children, or aging parents. As you enter this stage of life, the importance of Life Insurance increases, because people are depending on you.

How much life insurance should I purchase? This question can be a complicated one to answer, because everyone’s financial situations are different. As a general rule-of-thumb, many recommend a death benefit that is equivalent to 5-10 times your annual income. However, there are other contributing factors such as your age, education expenses, outstanding debt, funeral expenses, etc. For this reason, it is important to seek a professional’s opinion on how much you really need and we’re here to help!

Isn’t life insurance expensive? There are different types of life insurance, and each fit the needs of a life insurance policy holder differently. Premiums may be paid at different intervals, and as time goes on, it is recommended that you evaluate your life insurance policy with your current and future financial situations.

Life insurance can be a sensitive subject, but we’re here to help you navigate it all. With a life insurance policy, you can have the peace of mind knowing that in the event of your unexpected loss, the people that matter most to you will be taken care of, and have the financial support they need. To learn more, contact us or get a quote today!

When is it necessary to purchase a life insurance policy? Everyone is in a different stage of life, but it becomes most important when you have others depending on you such as spouses, children, or aging parents. As you enter this stage of life, the importance of Life Insurance increases, because people are depending on you.

How much life insurance should I purchase? This question can be a complicated one to answer, because everyone’s financial situations are different. As a general rule-of-thumb, many recommend a death benefit that is equivalent to 5-10 times your annual income. However, there are other contributing factors such as your age, education expenses, outstanding debt, funeral expenses, etc. For this reason, it is important to seek a professional’s opinion on how much you really need and we’re here to help!

Isn’t life insurance expensive? There are different types of life insurance, and each fit the needs of a life insurance policy holder differently. Premiums may be paid at different intervals, and as time goes on, it is recommended that you evaluate your life insurance policy with your current and future financial situations.

Life insurance can be a sensitive subject, but we’re here to help you navigate it all. With a life insurance policy, you can have the peace of mind knowing that in the event of your unexpected loss, the people that matter most to you will be taken care of, and have the financial support they need. To learn more, contact us or get a quote today!

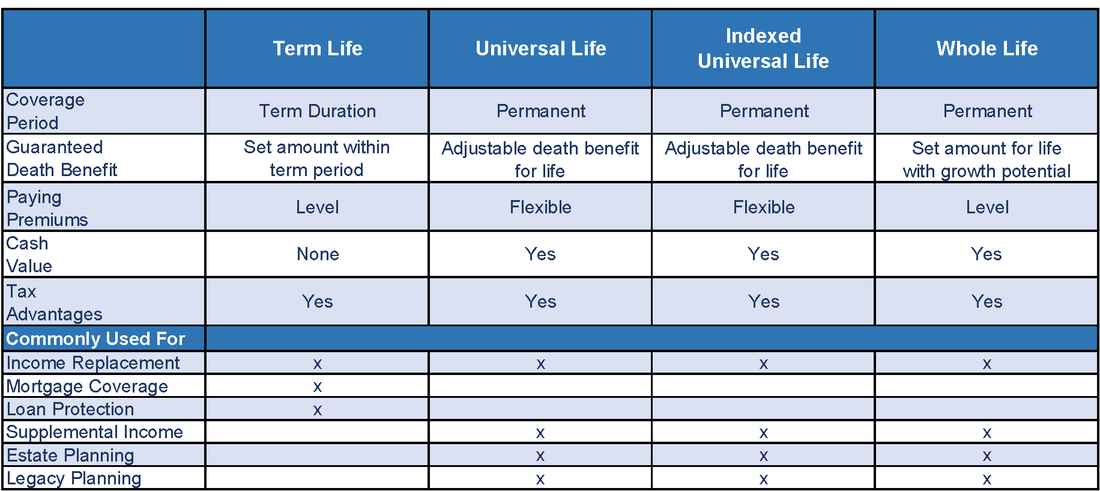

Term Vs. Permanent

Term Insurance – The death benefit for term insurance is level and typically between 10 and 30 years in duration. Annual premiums for shorter duration policies (10 and 15 year) are less expensive than longer durations (20 and 30 year).

Permanent Insurance – Permanent insurance is designed to provide a death benefit for life.

There are many, many types and variations of permanent policies with an almost infinite amount of flexibility. Permanent policies are considerably more expensive than term policies and develop some form of cash value. The flexibility and cash value crediting features vary widely among types of permanent policies.

A complete explanation of the various types of permanent insurance is well beyond the scope of this website. However, our representatives are well versed and capable of helping you select the most appropriate form of permanent insurance to fit your specific individual need.

As a general rule, a Guaranteed Universal Life (GUL) will provide the lowest cost permanent death benefit. The death benefit and premium will remain level for life as long as premiums are paid.

Permanent Insurance – Permanent insurance is designed to provide a death benefit for life.

There are many, many types and variations of permanent policies with an almost infinite amount of flexibility. Permanent policies are considerably more expensive than term policies and develop some form of cash value. The flexibility and cash value crediting features vary widely among types of permanent policies.

A complete explanation of the various types of permanent insurance is well beyond the scope of this website. However, our representatives are well versed and capable of helping you select the most appropriate form of permanent insurance to fit your specific individual need.

As a general rule, a Guaranteed Universal Life (GUL) will provide the lowest cost permanent death benefit. The death benefit and premium will remain level for life as long as premiums are paid.

Protect What Matters Most

Site powered by IXN Tech